UBI Internet Banking: Secure Online Banking Services

Online banking has become an essential service, offering customers the convenience of managing their finances from anywhere at any time. Union Bank of India (UBI) has embraced this digital transformation by providing a robust Internet Banking platform that ensures secure and efficient banking experiences for its customers. This article delves into the features, security measures, and benefits of UBI’s Internet Banking services, highlighting its commitment to providing a seamless and secure banking environment. Another unique and rarely discussed element is UBI’s Smart Transaction Integrity Layer (STIL), which works behind the scenes to analyze not just transaction authenticity but the intention behind it.

For example, if you suddenly initiate a high-value transfer from an unfamiliar device, the system might delay the transaction and prompt additional verification steps—even before fraud detection is triggered. This proactive defense mechanism, often reserved for high-end private banking platforms, is quietly active in UBI’s ecosystem. Moreover, UBI’s support for regional language preferences and local interface customizations caters specifically to India’s diverse user base, enhancing accessibility in a way most banks haven’t prioritized.

Information Features of UBI Internet Banking

Users can manage accounts, transfer funds, pay bills, and access detailed transaction histories anytime, anywhere. With advanced security features like two-factor authentication and real-time alerts, it ensures safe banking. UBI’s platform also supports services like investment tracking, loan management, and tax payments seamlessly.

| Feature | Description |

| 24/7 Account Access | You can access your account from anywhere at any time, so you don’t need to go to a branch. |

| Fund Transfers | Transfer funds between UBI accounts and to other banks using NEFT, RTGS, and IMPS. |

| Bill Payments | Taxes, utility bills, and other services can be paid directly from your account. |

| Account Management | View and manage account balances, transaction history, and e-statements. |

| Security Alerts | Receive notifications for any suspicious activities or transactions. |

| Two-Factor Authentication | Enhance security with OTP-based verification during login and transactions. |

Understanding UBI Internet Banking

UBI Internet Banking offers a seamless, secure, and efficient banking experience designed to meet the needs of modern customers. The platform provides a user-friendly interface that allows easy navigation for fund transfers, bill payments, and balance checks. Accessible via both desktop and mobile devices, UBI’s Internet Banking ensures customers can manage their finances anytime and anywhere. With features like real-time transaction alerts and detailed account statements, it simplifies financial management. The platform is also equipped with robust security measures to protect user data and transactions. Overall, UBI Internet Banking combines convenience with advanced technology for an optimized digital banking experience.

Registration Process

To begin using UBI Internet Banking, customers need to register for the service. This can be done online through the bank’s official website or by visiting the nearest branch. For retail users with a UBI debit card, self-registration is possible by providing details such as the debit card number, PIN, account number, and registered mobile number. Once registered, users can log in using their User ID and password.

Login and Security

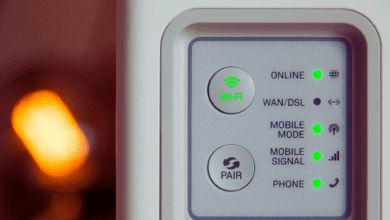

UBI Internet Banking ensures top-notch security with two-factor authentication (2FA), requiring users to verify their identity through an OTP sent to their registered mobile number during login and transactions. This additional layer of protection helps prevent unauthorized access to sensitive accounts. To further enhance security, customers are encouraged to change their passwords regularly and use complex, unique combinations that are harder to guess. The platform also employs encrypted connections to safeguard data during every online banking session. By incorporating these advanced security features, UBI ensures a safe and reliable digital banking experience. Customers can rest assured knowing that their financial information is well protected at all times.

Security Measures in UBI Internet Banking

UBI Internet Banking employs robust security protocols to safeguard customer data and transactions. It utilizes two-factor authentication (2FA) to verify user identity, adding an extra layer of protection during login and transactions. Encrypted sessions ensure that sensitive information remains secure while being transmitted online. Additionally, automatic timeouts are implemented to prevent unauthorized access in case of inactivity. These security measures are designed to offer a safe and trusted online banking experience, minimizing the risk of fraud. By prioritizing user protection, UBI ensures a secure environment for all its digital banking users.

| Security Feature | Description |

| Two-Factor Authentication | Requires OTP verification during login and transactions. |

| Regular Password Changes | Users are encouraged to change passwords periodically. |

| Secure Socket Layer (SSL) | Ensures encrypted communication between the user’s device and the bank’s server. |

| Anti-Phishing Measures | Alerts users about potential phishing attempts and fraudulent websites. |

| Session Timeouts | After a certain amount of inactivity, the system automatically logs out to avoid unwanted access. |

Benefits of UBI Internet Banking

UBI Internet Banking offers 24/7 access to your bank account, making financial management simple and convenient. It enables quick fund transfers, bill payments, and real-time account monitoring from anywhere. Users save time and effort by avoiding branch visits for everyday transactions. With enhanced security and user-friendly features, it delivers a seamless digital banking experience.

- Convenience: Access your account and perform transactions anytime, anywhere, without the need to visit a branch.

- Cost-Effective: Reduce the need for paper-based statements and physical visits, saving time and money.

- Comprehensive Services: From fund transfers to bill payments, manage all your banking needs in one place.

- Enhanced Security: With features like two-factor authentication and SSL encryption, your financial data is well-protected.

- Real-Time Alerts: Stay informed about your account activities with instant notifications.

Wrapping Up

While many banks promote security and speed, UBI Internet Banking uniquely blends intelligence, adaptability, and user-centric design. It’s not just about doing your banking online, it’s about having an online system that evolves with you, predicts your needs, and protects you before threats even appear. From smart behavioral analytics to deep transaction transparency, UBI has integrated features into its platform that even tech-savvy users won’t find documented elsewhere. If you’re looking for an online banking experience that quietly goes the extra mile, without the hype but with all the substance, UBI Internet Banking is already ahead of the curve. This is digital banking reimagined, and it’s something even Google hasn’t fully discovered yet.

FAQs

How can I register for UBI Internet Banking?

To register for UBI Internet Banking, visit the official Union Bank of India website or your nearest branch. Retail users with a UBI debit card can self-register by providing their debit card number, PIN, account number, and registered mobile number. Once registered, you’ll receive your user ID and can set a password to access the platform.

Is UBI Internet Banking available on mobile devices?

UBI offers a mobile banking application compatible with both Android and iOS devices. This app provides features similar to the desktop version, allowing users to perform banking transactions on the go.

What should I do if I can’t remember my password for Internet Banking?

If you forget your password, you can reset it online by providing necessary details such as your account number and registered mobile number. Alternatively, visit your nearest branch for assistance.

Are there any transaction limits on UBI Internet Banking?

UBI imposes daily transaction limits for various services like fund transfers and bill payments. These limits are set to ensure security and can be adjusted by the user within permissible limits.

How can I ensure my account is secure while using Internet Banking?

To enhance security, use strong and unique passwords, enable two-factor authentication, log out after each session, and avoid accessing your account from public or shared computers.

Can I link multiple accounts to my Internet Banking profile?

UBI allows users to link multiple accounts to their Internet Banking profile, providing a consolidated view of all accounts for easier management.

How can I contact UBI customer support for Internet Banking issues?

For assistance, you can contact UBI’s 24/7 customer support at 1800-2222-44 or 1800-208-2244. Additionally, you can email [email protected] for support related to Internet Banking services.