Few Myths About Travel Insurance

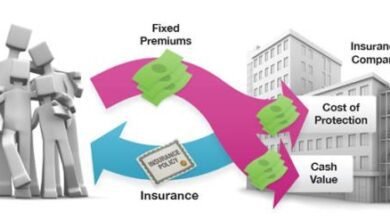

Embarking on a journey, whether for business or pleasure, brings excitement and anticipation. Amidst the thrill of exploring new destinations, it’s crucial to acknowledge the unpredictable nature of travel. This is where the charm of travel insurance unfolds, offering a safety net that can turn potential hassles into worry-free adventures.

The primary charm of travel insurance lies in its coverage for unexpected medical emergencies while you’re abroad. From sudden illnesse’s to accidents, travel insurance’s ensures that you have access to medical assistance without the burden of exorbitant costs

At a Glance Myths About Travel Insurance

Travel insurance is a valuable companion for any journey, providing a safety net against unforeseen events. However, misconceptions and myths about travel insurance’s can deter people from opting for this essential coverage. Let’s debunk a few common myths to shed light on the true benefits of travel insurance.

I’m Healthy; I Don’t Need Medical Coverage

Reality: While good health is a blessing, unexpected accidents or illnesses can occur anytime, anywhere. Travel insurance’s with medical coverage ensures you have financial protection and access to medical assistance’s, even in unfamiliar locations.

Myth 3: Travel Insurance is Expensive

Reality: The cost of travel insurance’s varies based on factors like destination, trip duration, and coverage. However, the expense is often minimal compared to the potential financial burden of unexpected events. Many affordable options provide comprehensive coverage tailored to individual needs.

Myth 4: My Credit Card Offers Enough Coverage

Reality: While some credit cards offer limited travel insurance’s benefits, they often come with exclusions and may not provide comprehensive coverage. It’s crucial to review the terms of your credit card coverage and consider additional travel insurance’s for enhanced protection.

Myth 5: I Can Buy Travel Insurance’s at the Last Minute

Reality: While some policies allow last-minute purchases, many benefits, such as trip cancellation coverage, require early enrollment. Buying travel insurance’s early ensures you are covered for unforeseen events that may arise before your trip.

Travel Insurance’s Covers Everything

Reality: Travel insurance has its limitations, and policies may not cover certain circumstances. It’s essential to read and understand the policy terms, exclusions, and coverage limits to avoid misconceptions about what is and isn’t covered.

I Only Need Insurance’s for High-Risk Destinations

Reality: Unexpected events can happen anywhere, even in seemingly safe destinations. Travel insurance provides a safety net, offering protection against various unforeseen situations, regardless of the perceived risk level of your destination.

Myth 8: Travel Insurances Only Covers Trip Cancellation

Reality: While trip cancellation is a significant aspect of travel insurance, policies offer a range of coverages, including medical emergencies, baggage loss, travel delays, and more. Understanding the comprehensive nature of travel insurance’s helps maximize its benefits

Read more: What are The Features of Fire Insurance in India?