Best Car Insurance Companies in India

Hitting the Brakes on Confusion: Choosing the Best Car Insurance in India

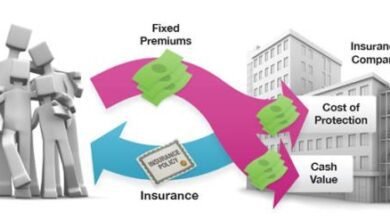

Cruising India’s vibrant roads is an experience, but with that freedom comes the responsibility of protecting your vehicle. Picking the right car insurance company can feel like navigating a maze, given the many options available. But relax, this guide will equip you with the knowledge to find the perfect insurance match for your needs.

Understanding Your Coverage Options

In India, car insurance comes in two main flavors:

Third-Party Liability (TP) Insurance: This mandatory coverage protects any damage your car causes to a third party’s person or property. Comprehensive Car Insurance: This broader coverage offers protection for your own car against accidents, theft, fire, natural disasters, and more.

Picking Your Perfect Partner:

When choosing a car insurance company, consider these key factors:

Claim Settlement Ratio (C.S.R. ): This reveals the percentage of claims the company settles. A higher CSR means a better chance of your claim getting approved.

Network of Garages: A wider network of cashless garages offered by the insurer translates to a smoother and faster claim process.

Customer Service: Look for companies known for prompt and efficient customer support, especially during claim settlements.

Price: Compare quotes from different insurers to find a plan that fits your budget while offering the desired coverage.

Add-on Covers: Consider additional covers like engine protection, zero depreciation, and roadside assistance to tailor your policy to your specific needs.

Top Contenders in the Indian Car Insurance Market

While the “best” car insurance company is subjective, some prominent players consistently rank high based on the factors mentioned above:

ICICI Lombard: Known for its extensive network, high C.S.R. and diverse product range.

HDFC ERGO: It is renowned for its focus on customer service, offering a hassle-free claim process and competitive premiums.

The New India Assurance Company: It is a trusted public sector insurer with a strong reputation and widespread network.

Acko General Insurance: A digital-first insurer offering competitive rates, a user-friendly platform, and a streamlined claim process.

Digit General Insurance: Another digital-first insurer known for its transparent pricing, easy-to-understand policies, and focus on customer satisfaction.

Shop around: Don’t settle for the first quote you receive. Use online comparison tools and get quotes from multiple insurers to find the best combination of coverage and cost.

Read the fine print: Carefully review the policy wording to understand the exclusions and limitations before finalizing your choice.

Renew on time: Maintaining a clean driving record and renewing your policy on time can help you avail of benefits like No Claim Bonus (NCB), which reduces your premium amount.

Read more: What are The Features of Fire Insurance in India?